ETF: Understanding Authorized Participants

- sonam Tamang

- Aug 5

- 5 min read

Updated: 1 day ago

What are Authorized participant ETFs?

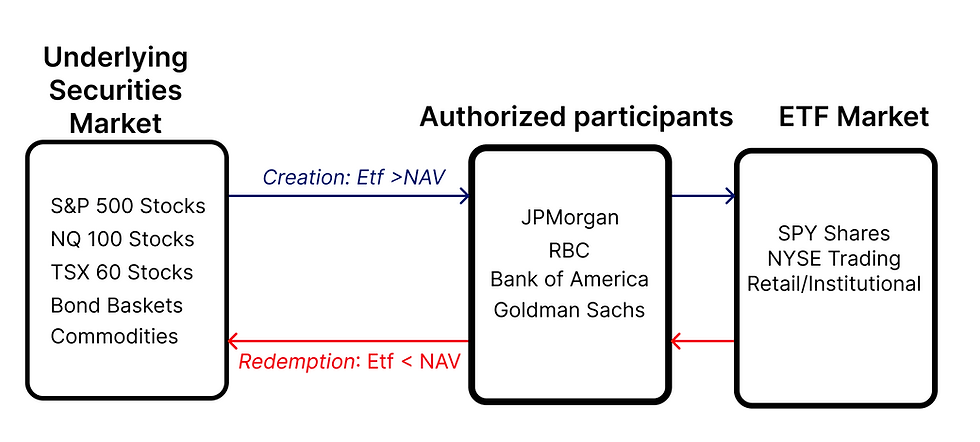

(APs) are fundamental to the functioning of the global ETF ecosystem, valued at over $12 trillion. They act as the sole link between primary and secondary markets. By utilizing the creation-redemption mechanism, APs ensure price efficiency by arbitraging differences between ETF market prices and net asset values (NAV). They also play a vital role in providing liquidity and facilitating price discovery. This analysis explores the precise operations of APs, their critical role during market stress, and the structural vulnerabilities that arise when this mechanism encounters operational or economic challenges.

I. The Structural Foundation: Defining Authorized Participants

Authorized Participants are large financial institutions—typically bulge-bracket banks and sophisticated market makers—contractually designated by ETF issuers with the exclusive privilege to create and redeem ETF shares directly with the fund. Unlike traditional market makers who provide liquidity through continuous bid-ask quoting, or retail/institutional traders who transact solely in the secondary market, APs operate at the intersection of primary and secondary markets, functioning as the arbitrage mechanism that maintains ETF price integrity.

Major APs in on fixed-income ETFs includes institutions such as:

JPMorgan

Goldman Sachs

Bank of America

Morgan Stanley

Citadel

ABN AMRO

These firms possess three critical capabilities that enable their AP function :

Operational Infrastructure: Direct connectivity to ETF issuers' creation/redemption platforms and clearing mechanisms through the Depository Trust & Clearing Corporation (DTCC)

Capital Depth: Ability to warehouse large baskets of securities (often $1-10 million per creation unit) during the creation/redemption process

Multi-Market Access: Simultaneous trading capabilities across cash equities, derivatives, fixed income, and international markets

II. Creation-Redemption Mechanism: Mathematical Precision

The Arbitrage Condition

The fundamental arbitrage relationship that APs exploit can be expressed mathematically:

Where:

n = Number of ETF shares in creation/redemption unit

PETF = Market price of ETF

NAV = Net Asset Value per share

TC = Total transaction costs

Creation Process (When PETF > NAV )

When an ETF trades at a premium to its NAV, the arbitrage sequence unfolds as follows:

Detection Phase: AP identifies that $SPY is trading at $650.25 while NAV = $650.00

Execution Phase:

AP purchases the underlying S&P 500 constituent stocks in exact index weights

Simultaneously sells $SPY shares short in the market

Creation Phase:

AP delivers the stock basket to State Street.

Receives newly created $SPY shares (typically 50,000 share creation units)

Settlement Phase:

AP uses new $SPY shares to cover short position

Captures spread minus transaction costs

Example:

Consider SPDR S&P 500 ETF (SPY) with the following parameters:

Creation Unit Size: 50,000 shares

ETF Market Price: $650.25

NAV per share: $650.00

Transaction Costs: $0.015 per share

Redemption Process (When PETF < NAV)

The redemption mechanism operates inversely when ETFs trade at discounts:

AP purchases undervalued ETF shares in secondary market

Submits redemption order to ETF issuer

Receives underlying securities basket

Sells securities at higher NAV-implied prices

This continuous nature of this bi-directional arbitrage creates a self-correcting mechanism that typically constrains ETF premiums/discounts to within 10-50 basis points for liquid equity ETFs.

III. Market Impact: Liquidity Provision and Price Discovery

Primary Market Creation as Liquidity Amplifier

APs fundamentally alter ETF liquidity dynamics through what market microstructure theorists term "liquidity transformation." Unlike closed-end funds where share supply remains fixed, ETF share counts fluctuate dynamically based on demand:

Price Discovery Enhancement

APs contribute to price discovery through three mechanisms:

Cross-Market Information Transmission: APs arbitrage pricing discrepancies between ETFs and underlying assets, transmitting information across markets

Volatility Dampening: By providing elastic supply/demand, APs reduce price impact of large trades

Lead-Lag Relationships: Research by Ben-David, Franzoni, and Moussawi (2018) demonstrates that ETF prices often lead NAV during information events, with APs serving as the transmission mechanism.

IV. Structural Vulnerabilities in International and Fixed Income Markets

International ETF Complexity:

International ETFs face unique AP challenges:

Time Zone Arbitrage Complexity: For iShares MSCI Japan ETF (EWJ), APs must estimate NAV using stale prices from closed Japanese markets, introducing basis risk:

Where NAVimplied uses futures prices, currency forwards, and ADR movements to estimate true NAV.

Fixed Income Structural Issues:

Fixed income ETFs present three structural challenges for APs:

Pricing Opacity: Many bonds trade infrequently, making NAV calculations approximations rather than precise values

Transaction Cost Asymmetry: Bid-ask spreads for bond baskets can exceed 50-100 basis points versus 1-5 basis points for equity baskets

Inventory Risk: APs must warehouse illiquid bonds during creation/redemption cycles, exposing them to duration and credit risk

These factors explain why fixed income ETF premiums/discounts regularly exceed ±1%, compared to ±0.1% for liquid equity ETFs.

V. Advanced Considerations for Proprietary Trading Applications

For proprietary trading firms, understanding AP dynamics offers multiple strategic advantages:

Predictive Modeling Applications:

// 1. Dislocation Prediction Model

function calculateDislocationProbability(marketData) {

const factors = {

marketVolatility: marketData.vix,

apCapacity: getAPBalanceSheetCapacity(),

underlyingLiquidity: marketData.bidAskSpread,

timeUntilClose: marketData.minutesToClose

};

return logisticRegression(factors);

}

// 2. Mean Reversion Strategy Signal

if (Math.abs(etfPrice - nav) > 2 * sigma &&

Math.abs(etfPrice - nav) < apTransactionCosts) {

// Fade extreme moves anticipating AP intervention

initiatePosition(direction: 'fade', size: calculateOptimalSize());

}This code is for informational purpose only doesn't contain ready to use code.

By monitoring AP bank earnings, regulatory filings, and risk metrics, firms can anticipate when APs might withdraw, creating tradeable dislocations.

Risk Management Implications:

Understanding AP mechanics enables superior risk management:

Liquidity Risk Calibration: Adjust position sizes based on AP participation metrics

Stress Testing: Model portfolio behavior under AP withdrawal scenarios

Execution Optimization: Time trades to avoid competing with AP creation/redemption flows (Usually 3:00-4:00 PM ET)

VI.Conclusion:

Authorized Participants represent the critical yet often invisible infrastructure enabling the $12 trillion ETF ecosystem. Their continuous arbitrage activity maintains price efficiency, provides liquidity transformation, and facilitates price discovery across global markets. For sophisticated market participants, deep understanding of AP mechanics offers competitive advantages in prediction, execution, and risk management. As ETF market share continues expanding potentially reaching $20 trillion by 2030, the role of APs will only grow in systemic importance.

The future evolution of AP mechanisms will potentially have more like iShares Bitcoin Trust ETF blockchain-based creation/redemption, algorithmic AP functions, or regulatory mandates for minimum AP participation will fundamentally shape market microstructure. Firms that deeply understand and anticipate these dynamics will possess significant advantages in increasingly ETF-dominated markets.

The AP mechanism represents both an opportunity and a risk factor in multi-asset strategies. By developing proprietary models to predict AP behavior, monitoring real-time creation/redemption flows, and understanding the economic thresholds that trigger AP withdrawal, Strategic trader can generate alpha through tactical positioning around ETF dislocations while maintaining robust risk management frameworks that account for potential liquidity gaps when APs step back.